We use cookies to provide you with the best possible online experience. Read our cookie policy.

Media Release

02 December 2025

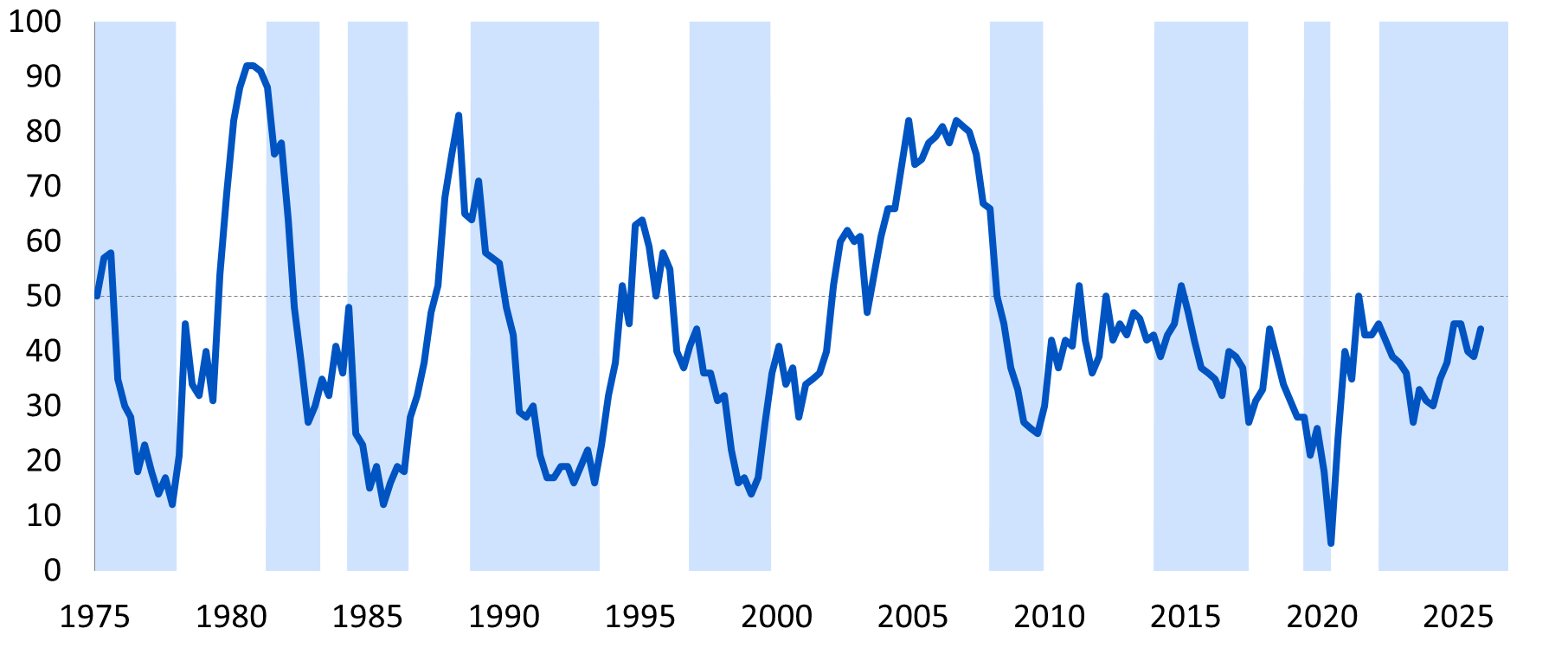

Encouraging uptick in business confidence

Following two consecutive quarters of declines, the RMB/BER Business Confidence Index (BCI) rose by five points to 44 in the fourth quarter of 2025, putting confidence three points above its long-term average. This means that 44% of respondents are satisfied with prevailing business conditions.

The rebound is notable for its breadth as confidence improved in five of the six sectors surveyed, with only building contractors registering weaker sentiment. Taken together, the results suggest that the economy is regaining some momentum after remaining subdued in the middle of the year. This is in line with the modest improvement in activity seen in the GDP data released by Statistics South Africa yesterday, which showed that the economy expanded by 0.5% quarter-on-quarter (seasonally adjusted), marking the fourth consecutive quarter of economic expansion.

According to Isaah Mhlanga, Chief Economist at RMB, “the key positive is that the improvement is broad-based. Even among building contractors, the only sector to dip this quarter, sentiment remains close to its long-term average. While this is not a step-change, it is a meaningful turn in the right direction.”

Figure: RMB/BER Business Confidence Index (BCI)

% satisfactory

Source: BER, SARB (Shaded areas represent economic downswings)

The survey took place from 10 to 24 November 2025. We observed some positive developments just before and during this period, including the removal of SA from the FATF grey list, as well as a credit ratings upgrade by S&P Ratings. In addition, local politics were relatively stable, with the Medium-Term Budget Policy Statement (MTBPS) being well received. The rand was fairly strong and, importantly, stable. The South African Reserve Bank (SARB) cut its policy interest rate by 25bps to 6.75% towards the end of the survey period, which is positive for the more interest-rate-sensitive sectors of the economy, particularly new vehicle dealers. This was despite inflation ticking up during the quarter, but supported by expectations of a lower inflation outlook amidst the confirmation of a shift to a lower inflation target of 3%.

Details

The improvement in confidence was broad based. The most notable improvement came from the manufacturing sector, where confidence rose by a solid 16 points to 39, although from a low level and thus still remaining among the most subdued among the surveyed sectors.

Table: Business confidence per sector

|

Indicator |

LT avg. |

24Q1 |

24Q2 |

24Q3 |

24Q4 |

25Q1 |

25Q2 |

25Q3 |

25Q4 |

change |

|

RMB/BER Business Confidence |

41 |

30 |

35 |

38 |

45 |

45 |

40 |

39 |

44 |

5 |

|

New vehicle dealers |

39 |

16 |

10 |

27 |

23 |

52 |

42 |

54 |

58 |

4 |

|

Retailers |

40 |

34 |

39 |

45 |

54 |

50 |

42 |

32 |

43 |

11 |

|

Wholesalers |

45 |

37 |

53 |

51 |

60 |

42 |

50 |

38 |

42 |

4 |

|

Building contractors |

40 |

42 |

47 |

41 |

51 |

45 |

35 |

46 |

39 |

-7 |

|

Manufacturers |

34 |

21 |

28 |

28 |

36 |

34 |

33 |

23 |

39 |

16 |

Source: BER

The rise in manufacturing business confidence followed three consecutive quarters of declines and brought confidence to its highest level since 2022. From an economic momentum perspective, it is important to note that production did not improve in line with the rise in confidence, but fixed investment indicators continued to look a little better, which is important for long-term dynamics.

Retail confidence also saw a big jump of 11 points to 43, from the third quarter confidence level that was unexpectedly weak. The rise brought confidence in line with averages recorded post-COVID. Importantly, sales volumes held up well relative to a strong fourth quarter last year, which is positive for consumer spending. Wholesale confidence also looked better with a four points rise to 42 and driven by better non-consumer goods sales volumes. Consumer goods wholesalers' sales remained unchanged, which might be a warning sign that the sustained momentum in retail spending may wane into 2026.

Like wholesalers, new vehicle dealers saw confidence increase by four index points to 58 and remain the only sector where the majority of respondents are satisfied with prevailing business conditions.

Finally, the only sector where confidence declined was building contractors where sentiment moved lower by seven points to 39. Despite the decline in sentiment, activity improved, which suggests that the sector continues to recover, but importantly the broader building sector continues to perform well.

Bottom line

The broad-based increase in sentiment is a welcome signal after a choppy year, especially given that we need to see higher confidence to reignite private sector fixed investment and job creation in the economy. According to Mhlanga, “it is too early to celebrate, we need to see this tentative improvement being sustained for a couple of quarters.” Continued structural reform progress remains pivotal so that improved demand can support a sustained improvement in production, leading to faster capex spend down the line. There are significant policy risk events in the next few years, both locally and globally, which could keep businesspeople on edge.

Another encouraging outcome of the survey results was how both purchasing and selling price inflation slowed down. This means the lower inflation target may be entrenched sooner rather than later, which could be positive for interest rate dynamics.

Looking ahead, it will be important to see if manufacturing output catches up with sentiment, if retail spending maintains momentum in 2026, and building contractors bounce back from this quarter's dip.

The Q4 RMB/BER BCI uptick is another green shoot. While promising, but still fragile, it will need steady policy progress and consistent demand to take root and grow.

Ends

Enquiries

Isaah Mhlanga

Chief Economist

Tel: 073 736 5357 / 011 282 1460

Isaah.Mhlanga@rmb.co.za