Reforms to SA’s reference interest rate are accelerating rapidly, with significant progress towards replacing the long-established Johannesburg interbank average rate (Jibar) with the new SA overnight index average (Zaronia) rate.

The Reserve Bank made it clear at an April 19 conference that it would like to see the switch to Zaronia happen as fast as possible. With the new rate now halfway through its intended observation period, data shows that the new Zaronia is behaving exactly as it should — opening the way for SA to just get on with it.

The Jibar is now the key money market reference rate and is supposed to represent banks’ cost of borrowing for maturities of up to 12 months. It underpins the rate at which banks can lend to their customers, and so has a wider effect on corporate borrowing and on the economy.

It is the most widely used reference rate in financial contracts, with the Reserve Bank estimating that the financial value of outstanding contracts referencing the three-month Jibar exceeds R340.6-trillion. Such contracts include derivatives such as interest rate swaps as well as bonds and other loans used by financial sector institutions and other professional users such as large corporate treasuries.

SA’s interest rate reforms are in line with a global effort to reform the reference interest rate that began a decade ago after the global financial crisis when the major markets embarked on modernising their interbank offer rates, such as the Libor (originally the London interbank offer rate).

SA began its rate reform process with the publication of a consultation paper in August 2018, and after working with a market practitioners group on a more detailed plan the Bank started publishing a daily beta version of the new Zaronia in August 2022, before beginning with the one-year observation period in November. Decisions about key dates for the next steps will be made only after the observation process ends on October 31.

Become comfortable

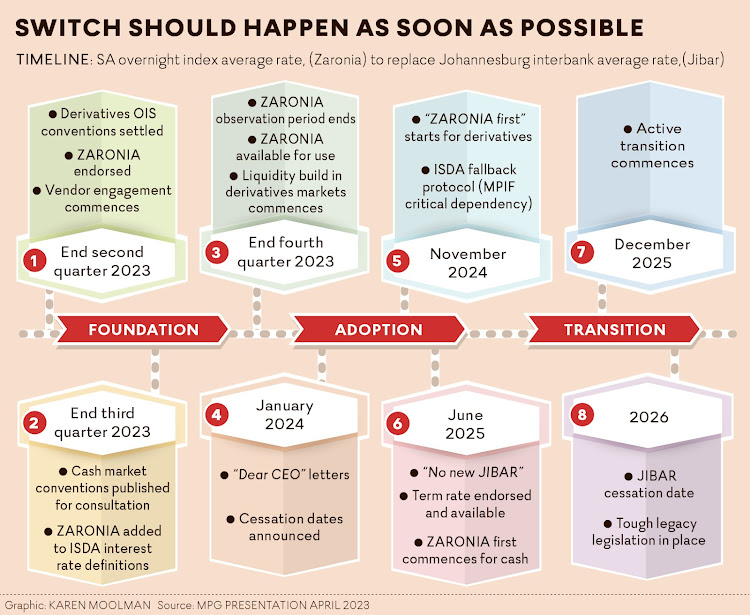

The switch from Jibar to Zaronia is a three-phase approach. Provisional timelines suggest Zaronia will be available for use in the derivatives market before end-2023, and for use in the cash markets, including bonds and loans, by mid-2024.

The plan allows a year for derivative market participants to become comfortable with the use of the new rate before “Zaronia first” becomes the norm in the derivatives market. This should allow for a build-up of liquidity in the derivatives market, which is required before the new rate becomes the norm in the cash market.

The key milestones will be when new derivative contracts no longer reference Jibar, and then when the cash market starts referencing Zaronia. June 2025 is the target date for moving to a “no new Jibar” contracts norm in the SA market.

Like its international counterparts, Jibar’s shortcoming is that it no longer reflects the cost at which banks fund themselves in the market, especially in the key three-month tenor. It is an indicative rate displayed by five contributing banks: not many deals are done at three-month Jibar.