We use cookies to provide you with the best possible online experience. Read our cookie policy.

Global Markets Daily: Oh, what a night

Global: Markets falter despite Fed predictability

SA: BCI at historic lows

Rand: Stuck between a rock and a hard place as USD/ZAR scratches at 16.70

Local rates: Offshore buying helps stabilise bonds

What to watch today

- UK RICS House Price Balance

- SA Mining Production

- SA Manufacturing Prod

- US PPI Final Demand (y/y)

- US Initial Jobless Claims

- US Continuing Claims

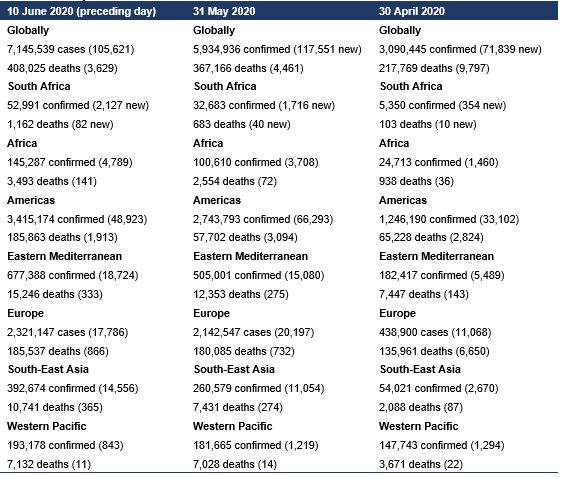

Covid-19 update

Source: WHO, NICD

Economics and markets

- The hype ahead of last night’s FOMC amounted to nothing as the central bank kept its options open.

- Markets were thrown no other morsels upon which to trade, with a brief nod to yield-curve control.

- Markets are fitful, crossing the threshold into the red amid what can only be described as a sudden pause in the aggressive risk rally.

- Real economic indicators struggle to show consistent signs of a nascent recovery and virus epicentres in the US report a spike in infections.

- The dour sentiment has bled into the EM currency complex, with the Brazilian real and South African rand pulling back from intra-week highs.

- Yesterday’s release of the RMB/BER Business Confidence Index (BCI) reflected how stressed corporates are with the reading falling to a historic low.

- USD/ZAR opens at 16.52; EUR/ZAR at 18.79; GBP/ZAR at 21.06 and CNY/ZAR at 2.33.

Our heading is a throwback to the 1970s. A time of bell bottoms, 8-tracks and disco. Unfamiliar terminology perhaps to Generation X, but the song title perfectly captures this morning’s narrative around the Fed.

The hype ahead of last night’s FOMC amounted to nothing as the central bank kept its options open, appearing neither dovish nor hawkish in its stance. Its position on the benchmark rate and openness towards further QE remains consistent: rates on hold for the foreseeable future while bond buying is open ended. The statement was rather predictable. Markets were thrown no other morsels upon which to trade, with a brief nod to yield-curve control, but no mention of the Evans rule (advocating for rates to be held near zero, at least until unemployment falls below 6.5% or inflation rises above 2.5%) or explicit forward guidance.

In the absence of anything new to jar markets, one would expect that risk-bearing instruments would end the day in the green. And yet, markets are fitful, crossing the threshold into the red amid what can only be described as a sudden pause in the aggressive risk rally. The performance of the S&P500 often sets the tone for Asia/Pacific trade, capturing the tone and texture of American happenings from the previous day. Down another 17 points from Monday’s close, the index has led global bourses into the red as the Fed cautioned against medium-term risks to the US economy.

Could that possibly be enough to derail the bear rally? Unlikely, but it does slow the trajectory, especially as real economic indicators struggle to show consistent signs of a nascent recovery and virus epicentres in the US report a spike in infections. That leaves us between a rock and a hard place. The dour sentiment has bled into the EM currency complex, with the Brazilian real and South African rand (this month’s best performing currencies) pulling back from intra-week highs. The OECD, in a dire assessment of the global economy in its latest economic outlook, has undoubtedly dampened the mood, highlighting unsurprisingly the need for structural reforms in SA to counter record unemployment levels and rising fiscal risks. While the spot level is scratching at USD/ZAR16.70, ending its longest appreciatory trend in almost 15 years, short-run implied volatility is holding firm, suggesting muted depreciatory risks.

The domestic risk premium is embedded in bond pricing rather than rand trade (refer to local rates section). Investors are looking ahead to the revised budget presentation, pencilled in for the last week of June, rather than individual data points. The data, though, is stark and speaks to the collapse in economic sentiment. Yesterday’s release of the RMB/BER Business Confidence Index (BCI) reflected how stressed corporates are with the reading falling to a historic low of 5 in 2Q20 – 13 points lower than 1Q20 and the lowest recorded sentiment in the BCI’s 45-year history.

Our macroeconomic team argues that the covid-19 pandemic has only taken an already weak economy and plunged it weaker. While all indications are for building activity and capex investment to decline hurriedly, we believe this to be the bottom of the current trend. The BCI sentiment should improve alongside economic activity. That probably won’t be apparent in today’s mining and manufacturing print though.

Oh, what a morning.

Nema Ramkhelawan-Bhana

Local rates

It has been the participation of offshore investors as well as the stronger rand that has helped local yields stabilise after the recent bearish move from 7.20% to 7.50% on the R186, as well as a steepening of the yield curve (the R2048 ultra-long bond has gone from 10.70% to 11.20%). Offshore investors have turned around their selling streak, which has characterised 2020, and have bought around R6bn in May so far. This should, however, be seen in the context of the increased issuance the market has to contend with, as their buying efforts only equate to one auction and, given the fact that all green-shoe options were exercised last week, that equates to more than R18bn in issuance this month already, including Tuesday’s auction.

No major surprises from the Fed last night, but the Dow was down almost 300 points, resulting in some profit-taking on risky assets, which have had a good run. This morning, the rand is weaker at around R16.73/$ after touching R16.40 late last night, and this sees bonds a touch weaker, currently marked at 7.62% on the R186 from a 7.59% close last night.

Locally, we have manufacturing numbers out this afternoon at 1pm, and also look out for US PPI at 2:30pm.