30 OCTOBER 2023

This article first appeared in Sunday Times Business Times on 29 October 2023.

Institute of International Finance figures are not as substantial as JSE’s

By Isaah Mhlanga

Capital outflows from South African markets always generate a divided conversation, especially when macroeconomic fundamentals are weak and socioeconomic challenges are on the rise. Lately, there have been two strands of debate. The first is that foreign investors in South African bonds and equities have sold off their holdings.

The second is that South African investors have taken billions out of the country when it needs capital to be invested in infrastructure to boost growth and employment. In both cases, these seem to be extreme views that do not pass the test of evidence.

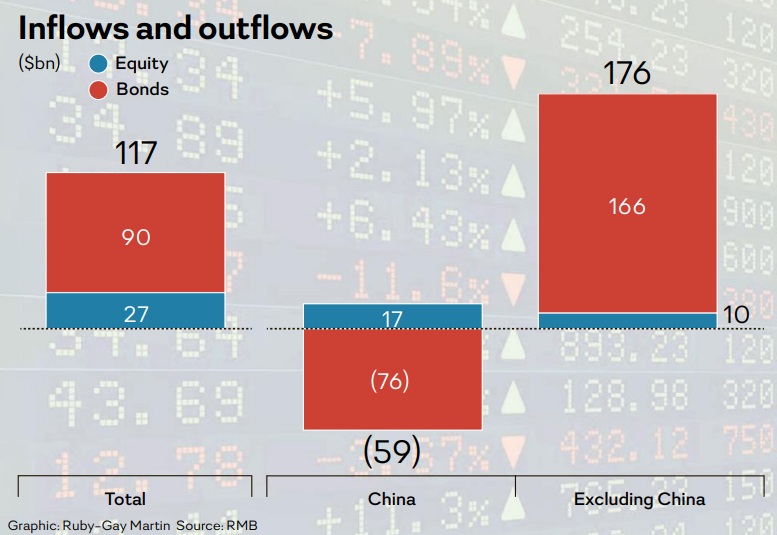

Regarding non-resident investors dumping South African assets, the data does not support the assertion that South Africa is the only unloved country. The Institute of International Finance (IIF) shows that non-resident capital inflows to emerging markets (EMs) amounted to $117bn between January and September this year, split between $90bn in bonds and $27bn in equities. China is an outlier as it saw outflows of $76bn from its bond market, the largest from EM bonds, followed by Brazil with $3.1bn. On the equity side, China saw inflows of $17bn, followed by India at $15bn. Excluding China, EMs had total inflows of $176bn split between flows of $166bn into bonds and US$10bn into equities.

As far as South Africa is concerned, using the same IIF data set shows that non-resident investors were net buyers of $2.0bn (R37bn) of bonds over the same period, which is not congruent with JSE data that shows $17bn (R312bn) in outflows. On the equity side, IIF data shows that non-residents were net sellers of only $0.8bn (R15bn), which is also very different from the JSE figure of $6.3bn (R116bn).

There have been questions about JSE data for a while. A possible reason for this discrepancy is how repurchase (repo) agreements and reverse repurchase agreements are accounted for. Reverse repos are simply legal purchases bonds which sell back at a defined later date of the bond, and vice versa for a repo. The JSE system might be following these legal conditions instead of the substance of the cash changing hands, which results in one leg of this trade not recorded correctly.