We use cookies to provide you with the best possible online experience. Read our cookie policy.

GM Daily: In limbo

Global: Three people confirmed to have contracted covid-19 twice

SA: July’s CPI to be today’s focal point

Rand: Inching ever stronger this week

Local rates: Ultra-long powers through auction

What to watch today

- JN PPI Services (y/y)

- SA CPI (y/y)

- US MBA Mortgage Applications

- US Durable Goods Orders

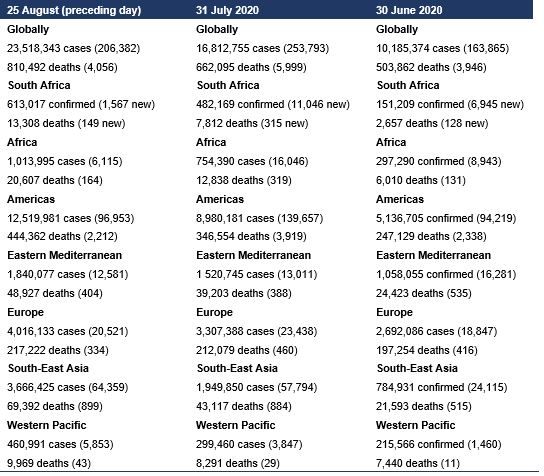

Covid-19 update

Source: WHO, NICD

Economics and markets

- Our understanding of covid-19 continues to develop, with only three confirmed cases of reinfection globally.

- Germany’s 2Q20 GDP fell to a post-war low of -9.7% q/q, no doubt a significant factor contributing to the extension of the employment protection programme to the end of 2021.

- Markets are in limbo. While the Dow fell slightly yesterday, the S&P 500 and NASDAQ continued their upward momentum and the Nikkei and Indian bourses were effectively flat this morning, though the Hang Seng and ASX are down a little.

- We expect the July CPI release to print at 3.0% y/y as fuel price deflation moderates and municipal rates and taxes, water and power charges continue to record stable but high rates of inflation.

- USD/ZAR opens at 16.86; EUR/ZAR at 19.95; GBP/ZAR at 22.16 and CNY/ZAR at 2.44.

That we are still working towards a proper understanding of covid-19 can be no clearer than in reports over the last two days that there are three people in the world confirmed to have caught covid-19 twice. It would seem previous reports of reinfection were instead cases of people experiencing an extended bout of the original infection, rather than two distinct infections. This is good news, as it means that while there is a risk of reinfection, it seems to be relatively low and the anecdotal evidence suggests that these three people have experienced a milder infection the second time around. In the meantime, it is full steam ahead on the development of vaccines.

In economic news, the final estimate for Germany’s 2Q20 GDP was slightly better than the first estimate, at -9.7% q/q. This is still a post-war quarterly low for one of the world’s industrial powerhouses. However, the good news is that Germany’s government has now agreed to extend its employment protection programme to the end of 2021 in a move to soften the translation of the economic blow into a household blow. This is a very bold move for Germany, which has focused on keeping its budget in surplus, or at worst, balanced, but is an appropriate time in which to unleash the resources it has been accumulating during periods of better economic performance. In contrast, the US is still without a new fiscal stimulus plan as discussions remain in stalemate, and focus seems to be turning to the upcoming elections. South Africa would do well to look at the German example as to why prudent fiscal management is important – Germany entered this crisis with tools to support the economy, South Africa on the other hand had an ever increasing deficit which has led to our need for support from the IMF and other IFIs.

Markets appear to be in limbo as we head into the middle of the last full week of August. With data releases not showing major surprises and covid-19 progress continuing, eyes are on developments in the US elections and geopolitical tensions. As such, the Dow fell slightly yesterday, while the S&P 500 and NASDAQ continued their upward momentum, albeit at a more muted pace. This limbo can also be seen in Asian trading today, with the Nikkei and Indian bourses effectively flat and the Hang Seng and ASX down a little. China’s bourse is down almost 1.5% today. Thus it will be anybody’s guess as to where the domestic market will go today. Having closed lower yesterday, there may be some scope for a bit of a recovery, however there is equally scope for a flat day of trading or an extension of losses.

Domestic economic guidance will come from the July CPI release, which we expect to print at 3.0% y/y as fuel price deflation moderates and municipal rates and taxes, water and power charges continue to record stable but high rates of inflation. A lower print would only strengthen the evidence for the SARB to cut interest rates further at its next MPC meeting next month, as the SARB will be forced to push its inflation forecast for the year lower.

Alcohol retail sales apparently scored a boost yesterday as rumours circulated that SA was facing yet another booze ban – however, Cogta has assured the public that this is fake news. What is worth keeping an eye on though is that Minister of Transport, Fikile Mbalula, has vowed that SA will have a zero alcohol tolerance level for drivers by the time parliament closes in December. This is an important move in trying to get South Africans to behave more responsibly when indulging in their favourite tipple, however, it will be enforcement that will be key to ensuring this actually happens.

On that note, for those with a boozy stockpile, please do enjoy it, but do so responsibly.

Siobhan Redford

Local rates

Although the flows have been light on the nominal front, the price action has been relatively interesting, with some steepening bias on the back of an underwhelming R186s non-comps take-up last week. With EM risk sentiment remaining mildly positive, the National Treasury came to market to issue R186, R2030s and R2048s. With the ultra-long middling at 11.50 in the opening session, a strong auction did not come as a surprise given the elevated yield levels on offer. The R186s cleared auction at 7.33 (market 7.36) at a bid-to-cover ratio of 2.80, while the R2030s cleared auction at 9.26 (market 9.28) and the R2048s cleared 5bp stronger than market, with a commanding 3.46 bid-to-cover ratio, clearing auction at 11.44 (market 11.49). Throughout the day, flows remained light and, coupled with poor auction follow-through demand, the nominal curve remained around the auction levels. With the curve remaining steep, the R186/R2048 spread is middling at 409bp this morning, with limited scope for the R186s to trade lower. Liquidity in the swaps market remains depressing, especially around the 12-yr to 15-yr part of the curve. While the longer part of the curve offers better liquidity, trade activity has been non-existent for the past few days. The rand is trading 10 cents weaker this morning at around 16.83.